A lot has been written in recent days about the proposed Dutch tax on unrealized gains from securities appreciation, and there are many synthetic calculation examples floating around, some of which look pretty bad.

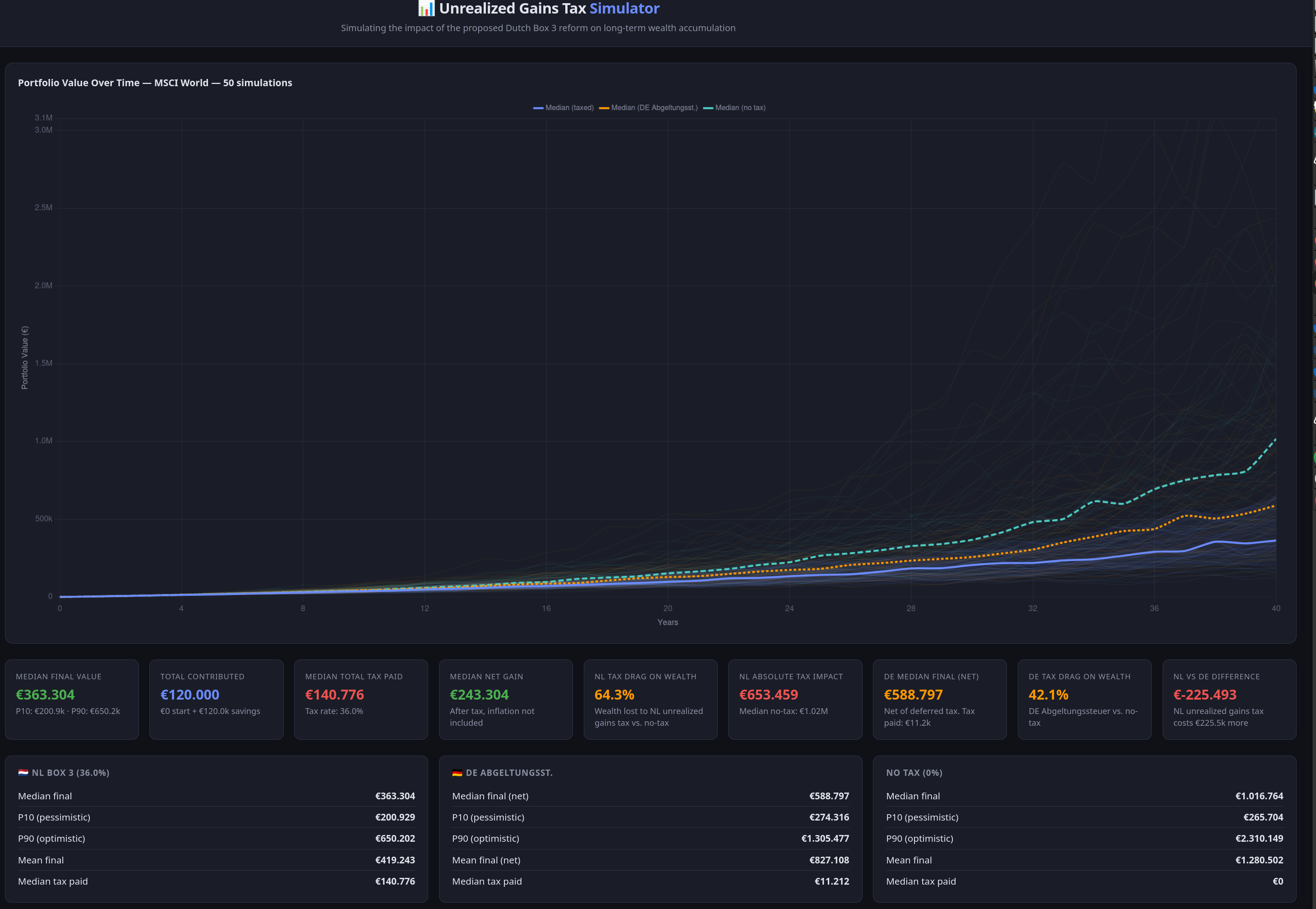

But I also wanted to know how it actually plays out "in the median" in practice - which unfortunately you can't just calculate with a pocket calculator since you don't know future price developments.

The Solution: Monte Carlo Simulation

So I built a small Monte Carlo simulation as a web app that lets you play through different scenarios.

Key Findings

The tax drag on wealth goes through "sequence of returns" effects well beyond the nominal tax rate of 36% in some cases, but it varies widely.

The absolute horror scenarios are relatively rare due to a little-reported detail of the rule - namely a possible loss carryforward. But the impacts can still be significant.

Tool to Try It Yourself

The tool is freely available and open source under the "DO WHAT THE FUCK YOU WANT TO PUBLIC LICENSE".

→ Unrealized Gains Tax Simulator

Try it yourself and form your own opinion about the effects of this proposed tax regulation!

What the Simulation Shows

The Monte Carlo simulation takes into account:

- Different market scenarios with realistic return distributions

- The effect of annual taxation of unrealized gains

- Loss carryforwards according to the proposed regulation

- Long-term impacts across different time horizons

So you can see how the tax actually plays out under different market conditions - beyond the simplified calculation examples.